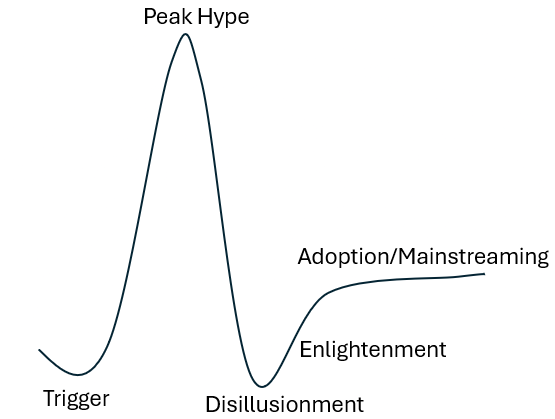

The Hype Cycle is a cliche in tech circles at this point. Most people are familiar with the investment implications of the cycle.

The accepted way of thinking about hype cycles is as singular events - bubbles inflate and then burst before reaching sustainable steady state.

The mental model that investors have for the adoption/mainstreaming phase is established companies with solid products, millions of users and free cash flow.

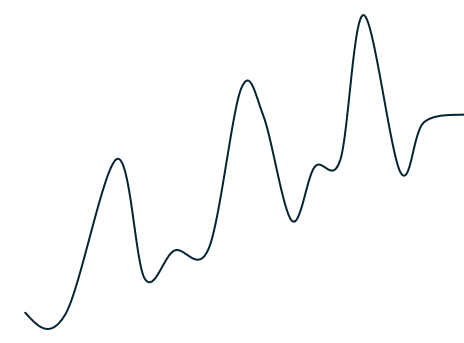

Crypto forced people to modify this mental model. There is an endless supply of new narratives, products and infrastructure in crypto. The consequence is that the hype cycle is not a singular event, especially from an investment perspective.

New narratives emerge before disillusionment sets in and keep building on the momentum of previous cycles.

The mistake that TradFi investors made with crypto is applying a singular hype cycle hypothesis to crypto. Intellectual honesty would demand asking why market caps keep re-inflating periodically.

With generative AI, the situation is arguably worse because of the increasing frequency of the supply of new narratives. OpenAI is scheduled to release GPT5/Project Strawberry this week. Rumors are that the jump in capabilities from GPT4 to Strawberry are at least as big as the jump from GPT2 to GPT4.

Everyone will undoubtedly grapple with the implications if this is true. But this is particularly true of TradFi investors. The argument that such investors have always relied on is that narrative-price reflexivity is always subject to the gravity of the reality of earnings.

This argument makes sense for singular bubbles. But when one has an endless supply of narratives, big corrections don't reset prices completely. 70, 80% corrections re-inflate quickly because newer, more promising narratives emerge, supported by a lagging buildup of infrastructure and applications even if mainstream adoption isn't achieved.

In such markets, the cardinal sin that an investor can make is being 100% out of the market waiting for a valuation reset to some notion of fair value. Crypto market participants have learnt this lesson the hard way over previous 4 year cycles.

I don't manage money professionally, so this obviously isn't financial advice, but it seems straightforward to me at this point that TradFi investors need to internalize these lessons quickly.