The Web2 Data Economy monetizes Data in three primary ways. The first is through Data-as-a-Service business models. Examples include private Data Marketplaces on web infrastructure providers such as AWS Data Exchange. The second is through subscription-based API Data Access for a whole host of applications. Examples of this category are too numerous to list exhaustively, but Google Search and Maps API are two prominent examples. The final, and most ubiquitous model is monetizing user data through online advertising. I wont bother giving examples of this category because you've likely heard of the prominent examples.

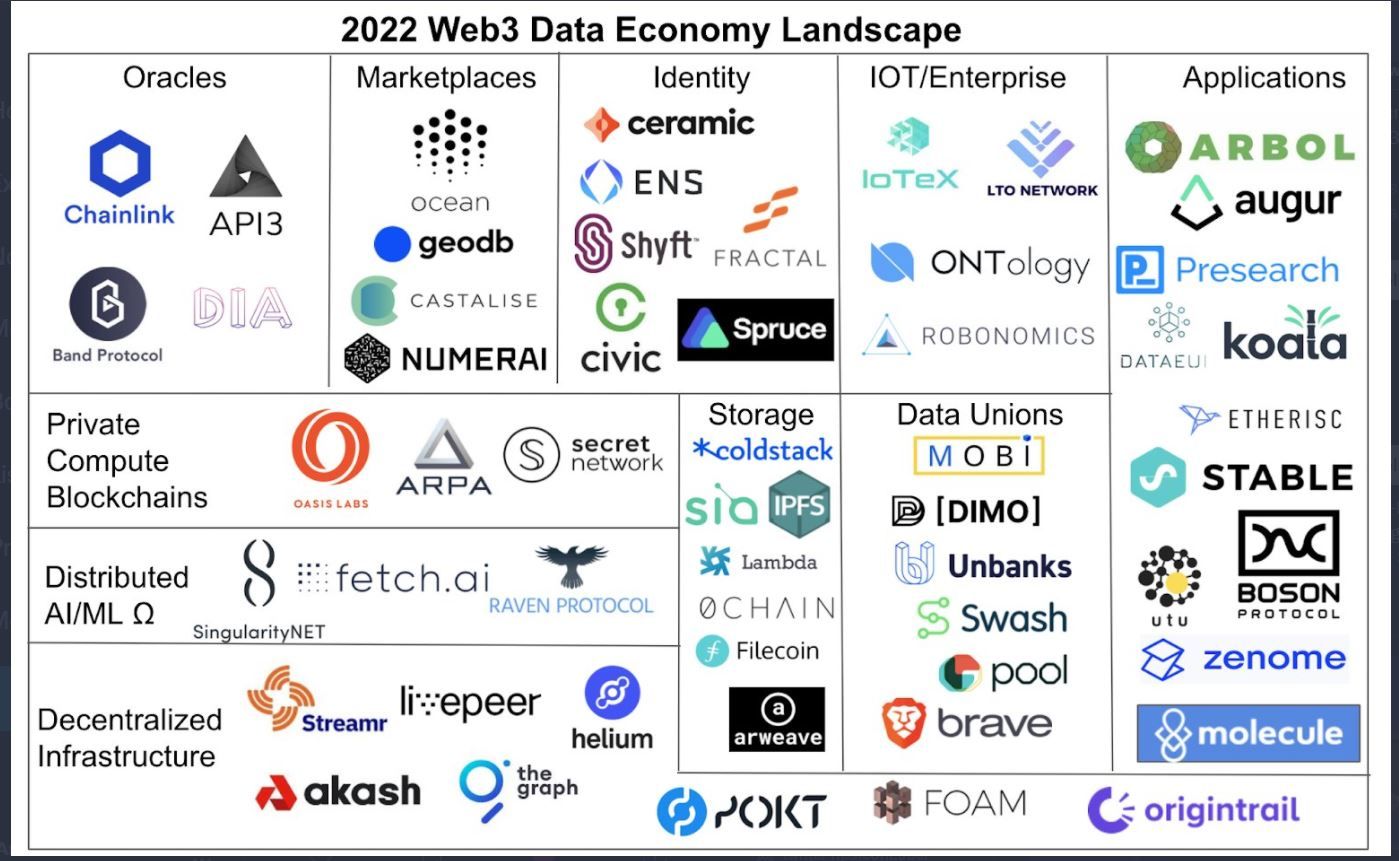

In parallel to the Web2 Data ecosystem, an entirely new open Data ecosystem based on Web3 principles is being built out. Data Access monetization protocols such as Ocean, Data Unions such as Swash, Data Storage protocols such as Filecoin and Arweave and a whole host of protocols that either provide or rely on Data Access (Chainlink, Livepeer, BAT) are recent examples of Data-centric Web3 business models.

At this stage, we don't know for certain which vision for the Data economy will win. I'm rooting for the one that starts with Web and ends with 3!

Regardless of my personal preference, I thought it might be useful to combine the bottom-up reasoning in a previous article with some top-down reasoning by analogy to mainstream finance to outline a thesis for how I expect Data Access to be financialized.

Going beyond the technology of Data tokens and their price, which tends to dominate discussions in this space, this thesis tries to map out the effect that Data Access financialization would have on a number of factors: availability and valuation of Data assets, their price distributions, new players and the need for new Data infrastructure in the Web3 Data economy and the coming role of financial and political regulators in this space.

So here's what comes next. In the first two articles in this series, I first back-up and review the common definition of financial assets. I examine if Data by itself can be a Financial Asset. Next, I compare the relative merits of Shares vs Web3 tokens as instruments for packaging Data Access. Having reviewed this background I finally lay out my thesis in the final article.

Here are the key takeaways from each article in the series.

A Financial Asset is a tradeable instrument that gets it's value from demand and supply. Data by itself is not a Financial Asset. The right to access (Own, Use) a Data Asset (Data, Data Models, Algorithms), packaged into a tradable instrument can be considered to be a true Financial Asset.

Web3 Tokens can be programmed to fit a wide variety of use cases and liquidity requirements. They also have a massive first-mover advantage in packaging Data Access. Web3 tokens will be the preferred packaging to convert Data Asset Access into a bonafide Asset Class.

Assuming that Data Asset Access is a bonafide Asset Class in the future, how does the world look like?

Downstream of Data Asset Access tokenization, a number of derivative financial products - options, bonds, ETPs and so on - will be created and traded on DExes and CExes. Data will become commoditized with a $ value for each row/blob of structured/unstructured data.

Dynamic Data that is continuously updated and reflects changing trends will be highly valued. Structured blockchain data will be commoditized. Tokenized Algorithms trained on Tokenized Datasets will replace custom-built ML models for a wide variety of industries

In a world where Data Asset Access is a commodity, an ecosystem dedicated to the continuous evaluation and pricing of it will emerge. Formal Data Asset Valuation will become a subject of study. Formal techniques analogous to present-day discounted cash flow analysis for equity valuation will be created for Data Asset Valuation.

Players in the new Data economy

Due to the inherent friction in tokenizing personal Data, individual and transactional corporate Data will flow into Data Unions, which will emerge as power players. Product/IP related corporate data will flow into industry specific Data Unions. Data Specialists (Blockchain Data Engineers, Data Asset Curators, Data Asset Valuators) will benefit immensely from avenues for multiple revenue streams. Professional investors will dip their toes upon sufficient maturation of the asset class.

Emergent effects due to other Web3 developments

Streaming payments, composability on open data models, DAOs and so on, will intersect with Data Asset Access tokens in unanticipated ways to create new products, business models and protocols.

The role of financial and political regulators

Data Asset Access tokens are qualitatively different from other crypto commodities such as Bitcoin which are bearer assets. Owners of base IP will have culpability in case violations of sanctions (export control, for instance) or law are discovered. Corporations and research institutions will weigh the tradeoffs of economic benefits of tokenizing Data versus legal complications. This could have a chilling effect on the broad, global availability of truly useful Data.

Needless to say, this is my personal take based on what I see as likely to happen over the next few years. I'll evaluate how this thesis plays out in yearly reviews. Hope you enjoy reading!

Disclaimer: None of the content in this article series, or this website in general is Financial Advice.

Thanks to Richard Blythman, Craig Danton, user ndehouche on Discord for reading through the manuscript and providing feedback.