Shayon Sengupta recently wrote about the "Attention Theory of Value" in Multicoin Capital's 2024 predictions for crypto. His use of the term "Attention Theory of Value" to describe speculative price discovery in meme coins, NFT, GME/TSLA and the like certainly caught my attention (pun intended).

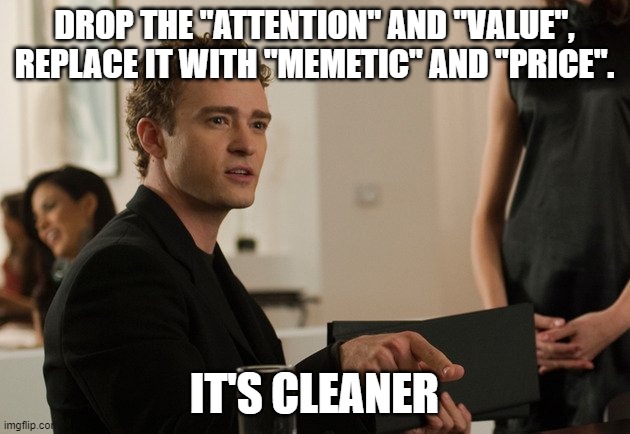

I think the idea is essentially correct but the term needs some rethinking. I offer a few modifications below based on my own recent thinking on this topic.

- Value is subjective. Price i.e. the exchange rate of an item for the purchase of goods is a comparatively more objective measure [1].

- Crypto allows, for the first time, the direct monetization of subjective value through the permissionless creation of and participation in markets around ideas, narratives and memes. This is exclusively a crypto superpower.

- Permissionless participation in initially illiquid markets around ideas, narratives and memes causes gigantic price increases and 'forces' memetic participation through a reflexive attention->price feedback loop.

- Crypto therefore memetically monetizes memes, ideas and narratives.

- 1 through 4 above imply that in speaking about memes, narratives, NFTs and other items with subjective 'value', one should have a Memetic Theory of Price and not an Attention Theory of Value.

I suspect this is also the point Sengupta was trying to make though he chose different terms.

Price vs. Value

Value is a loaded term and has been for a long time. Communists think that labor has value above other things, while Capitalists think that capital deployed productively with the right incentives creates and has value in and of itself. Warren Buffet thinks gold is a pet rock while gold bugs swear by it's millenia-long history of being a store of value. Bitcoin maxis think only BTC can store value, while Jamie Dimon and Elizabeth Warren think it has no intrinsic value or industrial utility and is merely a speculative instrument.

We cannot create a theory for something that is so subjective because it eludes measurement and prediction. Price is comparatively objective [1].

Attention vs. Memetics

Attention monetization is not new. It's been with us since we've had direct-to-consumer advertisements via billboards, newspapers, magazines, radio and television. It is the underlying business model of Web2 companies. We get free access to applications developed by Web2 giants like Google, Meta and so on and in return, we allow them to monetize our attention directly (via advertisement) or indirectly (via selling data when applicable).

When applied to markets, the difference between attention and memetic behavior is subtle but impactful. Attention turns to memetic behavior only when a memetic equal or inferior (a neighbor, an Island Boi, a local gangster) is suddenly seen becoming rich, or gaining fame without seemingly much effort (see Wanting by Luke Burgis for a detailed description). In other words, attention is a necessary but insufficient factor in memetic behavior.

Further thoughts

- The low barrier of entry for creating memetic monetary instruments was previously countered by a high cost of transaction on legacy crypto rails. Cheaper blockchains with lower creation, deployment and transaction costs will cause the cost of memetic monetization to trend to zero, especially as the application layer infra continues to develop.

- Millenials and GenZ'ers are digital natives and understand the power of memes intuitively both from a demand (passive consumer) and supply (creator) perspective. Having subsidized the creation of memetic technology (social media) through their attention, they will have the ability to now monetize memetics directly. Real world assets continue to trend out of their reach. Couple it with a near zero cost of creating memetic monetary instruments and it's easy to see why we will have a lot of memetic monetization experiments coming our way.

- If a market for creating, consuming and monetizing memes is present, can a platform dedicated to memetic monetization be far behind? Memetic infrastructure companies will be a thing. We will see more robust solutions to weed-out obvious rug-pulls and scams and automated solutions to ensure creators don't run afoul of securities laws in their respective jurisdictions.

- Intangibles - memes, lists of nouns, low res jpegs and the like - are easier to create than infrastructure and utility. Contrary to the expectations and desires of 'legitimate' participants in the space, memetics will continue to grow along with infrastructure and application plays. The incentives are simply too strong to dis-incentivize the growth of this space.

- As I'm typing this out, the following series of events have occurred. Franklin Templeton, a venerated asset manager with over a Trillion USD in assets, tweeted about the 'dogwifhat' meme, suggesting that it would be amatter of time before it's mascot, a picture of Ben Franklin would wear one. In a matter of an hour, a memecoin called $BWIF began trading on Decentralized Solana exchanges and has already accumulated close to 300K USD of capital as of this writing!

- I'll write more on this topic, especially about the 'theoretical' aspects of memetic price discovery. Being subjective and completely reflexive, it's difficult to predict the price of a meme, but we can analyze already popular memes to figure out the qualities that result in memetic price action.

[1] - Why comparatively? Because pricing objects in a base currency requires us to assign value to this currency, which we just said was a subjective process!